Personal Umbrella Insurance

How important is Personal Umbrella Insurance?

If you are sued, do you have enough liability insurance protection on your home insurance and auto insurance to protect you, your family and your assets?

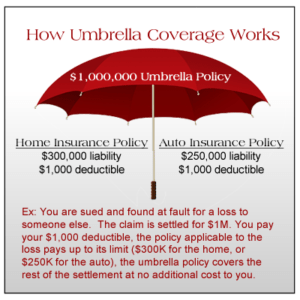

Do you even know what underlying insurance coverage means? Most people don't. Once the liability insurance limits are exhausted on your home, auto, or other insurance policy, a Personal Umbrella Insurance policy provides a second layer of insurance coverage of one-million dollars or more depending on your assets. For example, if you own your home, a rental property or cash savings in the bank and you are sued for a car accident, some trips an falls at your home or rental property or you are sued for libel or slander, a personal umbrella insurance policy protects you and your assets.

Do I need Personal Umbrella Insurance?

Some ask, if I don't have assets, what can I be sued for? People are oftentimes sued for the equity in the home or their wages are garnished. One-million dollars of personal umbrella protection can be purchased and packaged with your home and auto insurance usually for less than $15 per month! Why not protect yourself and your family?

Can I Afford Personal Umbrella Insurance?

If you own a home, rental properties, autos, RV's or have youthful drivers, you should strongly consider a personal umbrella insurance policy.

If you own a home and auto, most couples with a good driving record can purchase a $1,000,000 personal umbrella policy for less than $20 per month. Families with young household drivers, will pay more, however a personal umbrella is very important to protect those families and their assets.

Personal Umbrella Insurance is very affordable and you will have the peace of mind knowing you're protected.

Examples of why Personal Umbrella Insurance is so Important

- Do you have youthful drivers in the household? Statistics show youthful drivers have less driving experience and pose a greater risk to you

- What would happen if your dog was to bite a neighbor's child?

- Do you own rental property(s)? What if there was an accident on your rental property?

- What if someone in your household was at fault and severely injured or killed another person(s) in an auto accident?

- What would happen if a fire in your condo spread to other units?

- There was a drowning in your swimming pool?

If any of these things happened to you, there's a good chance your current liability limits wouldn't be adequate to protect your assets, or your future earnings.

Client Reviews & Testimonials

About Greene Insurance Group

Insuring families & businesses since 1962

At Greene Insurance Group, our family has been dedicated to safeguarding families and businesses with comprehensive insurance solutions for over 63 years. As an Independent Insurance Agent, we represent dozens of top-rated insurance companies, saving you the time and hassles of shopping for insurance. You can rest assured you receive the best coverage at the best value to maximum protection!

At Greene Insurance Group, we promise to provide personalized and best-in-class customer service. Our Licensed Insurance Agents work in our local offices, ensuring your privacy and personal information are always protected. It's a commitment we stand by. We answer your calls and return your emails—because that's the way it should be. You can always depend on the professionals at Greene Insurance Group.

Insurance Tailored For You

Greene Insurance Group is large enough to serve all your insurance needs, but small enough to care. We take great pride in providing our clients with personalized products and services tailored to fit their individual needs from top-rated insurance companies.

We invite you to call Greene Insurance and we'll help you review coverage options for your personal insurance or business insurance needs. "We provide free, no hassle, no obligation insurance quotes". The Insurance Professionals at Greene Insurance Group are here to help you make informed insurance decisions.

Affordable & Reliable Choices for Insurance

Greene Insurance Group strives to offer quality insurance coverage, a high level of professional service and a long-term relationship. As an Independent Insurance Agent, we research rates and coverage from dozens of top-rated insurance companies to find the best rates and coverage for you saving you time and money.

We're an Independent Insurance Agent

Benefits of working with Greene Insurance Group:

- Choice & Flexibility – As an Independent Insurance Agent, Greene Insurance Group offers insurance from dozens of top-rated insurance companies, unlike captive insurance agents who are limited to a single insurance company. Greene Insurance Group is a leading Independent Insurance Agency growing throughout the United States.

- Personalized Service – At Greene Insurance, we prioritize personalized service. Once you become a client of Greene Insurance, our Licensed Account Manager and their team will be here to assist you with questions, policy changes, billing, review your renewals and assist with claims.

- Insurance Products of all types – We provide personal insurance such as: home, autos, fine arts, jewelry, RV's, umbrella, yachts, aircraft, and much more and business insurance such as: Commercial Liability, Commercial Property, Professional Liability, Workers Compensation, Commercial Auto, Commercial Umbrella and more.

- Ongoing Support – The relationships we build with our clients are why so many refer their friends and family. At Greene Insurance Group, we offer a responsive team, work in professional offices within the United States to protect your family and your privacy. Our licensed Insurance Agents are always available to answer your questions and provide ongoing support, unlike faceless websites, chatbots or call centers.

- Expertise & Advocacy – Greene Insurance Group has the expertise in the insurance marketplace to help you understand your insurance and coverage options. As your insurance advocates, we'll guide you through the claims process to help ensure you receive fair treatment.