High-Value Home Insurance by Cincinnati Insurance Co.

Cincinnati Executive Capstone Home Insurance for High-Value Homes

The Executive Capstone Home Insurance Policy is designed specifically for high-value homes over $1.5 million dollars and up.

The Cincinnati Insurance Executive Capstone Home Insurance policy covers the full cost to rebuild your home, in most states, and uses professionals to help establish the cost to reconstruct your high-value home with all its special features.

Additional coverages include:

- Water damage due to sump pump failure, backup of a sewer or drain.

- Loss from operating your golf cart to visit friends, go shopping or to the golf course as long as your golf cart is not licensed for road use.

- Wildfire Protection Service provides potentially home-saving wildfire mitigation services.

- Kidnap and ransom expense for your or a covered family member who is wrongfully taken or detained.

Add optional Enhancements for your Homeowners Policy

Our set of optional homeowner policy enhancements allows you to add additional coverages to your policy to ensure your high-value property is secure. Coupled with our exceptional local claims service, these unique coverage options add additional protection and security for you and your family.

- You can receive coverage for damage to or by golf carts, on or off the course.

- You can add our Identity Theft Expense Coverage and Advocacy Service.

- Personal Cyber Protection, which can be added to your Cincinnati home, condo or tenant policy, protects you from a range of personal cyber risks.

Car Insurance by Cincinnati Insurance Company

As a Cincinnati Insurance Agent, we’ll help you understand your Cincinnati Auto Insurance coverage.

“Consider the Cincinnati Difference”. Not all car insurance policies are created equal. In fact, we’ve listed some of the reasons Cincinnati Insurance Company’s auto policy stands out from the crowd.

Available Auto Features:

Insurance Coverage for Rental Cars

You receive our industry-leading coverage for rental vehicles when you purchase auto liability coverage with Cincinnati Auto Insurance. Should you have a covered accident in a rental car, claims are paid under your auto policy’s liability limit, with no deductible, in most states.

Cincinnati Insurance Company’s Auto Insurance covers physical damage to the vehicle, plus the rental company’s lost income while the vehicle is out of use. Other insurance companies may insure rentals under the auto policy’s physical damage coverage, requiring you to pay your policy deductible and buy coverage from the rental company for its lost income.

Combine your Auto, Home & Umbrella Insurance Policies for the Best Value & Convenience

Optional Enhancements:

- Capstone Auto Policy

- Personal Auto Plus

- Replacement Cost Plus

- Antique or Collector Car Insurance

- Gap Coverage

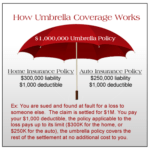

Personal Umbrella Insurance by Cincinnati Insurance Company

Protect your hard earned assets with Personal Umbrella insurance from Cincinnati Insurance Company. Imagine if your dog were to bite a neighbor’s child, if there’s an accident on your rental property, fire in your condo spreads to other units. What would happen if you or a family member missed a stop sign and struck and killed a pedestrian? If any of these things happened to you, there’s a good chance your current liability limits wouldn’t be adequate to protect your assets or your future earnings. A personal umbrella insurance policy is very affordable and for most families less than $250 annually. Ask our agent for more information.

Private Client Insurance Agent – Insuring our Affluent Clients throughout the United States

High-Value Home Insurance – Own a multi-million dollar high-value home? Very few insurance companies insure high-value luxury homes. The Private Client Group at Greene Insurance insures multi-million dollar luxury homes for our affluent and high-net worth clients throughout the United States.

Client Reviews & Testimonials

Cincinnati Insurance Agent in Arizona

Cincinnati Insurance Company offers the Financial Strength to Protect it’s Clients

Founded in 1950, Cincinnati Insurance Company is among a select group of insurance companies that have been ranked A+ or higher by A.M. Best Company for more than 50 years. A.M. Best and three other independent rating firms award our property casualty and life operations with strong insurance financial strength ratings that assess our ability to meet our financial obligations to you.

Cincinnati Insurance provides you with unparalleled claims service, convenient technology solutions, competitive products and empowered, local Cincinnati Agents.

Our Values

Cincinnati Insurance Company is commited to the practices that go beyond what is required, our associates consistently deliver services and insurance products to protect what matters to you.

Relationships

As your Cincinnati Insurance Agent, we become your trusted advisor and work with you to adjust coverage to meet life’s changes.

Financial Strength

Cincnnati Insurance Company is AMBest A+ rated and ready to serve and help restore you after a covered loss.

The Private Client Group at Greene Insurance Group

Since 1962, our family has been protecting families and businesses through personal insurance and business insurance products.

The Private Client Insurance Team at Greene Insurance Group specializes insuring high-value luxury homes, luxury automobiles, collector autos, classic vehicles, exotic sports cars and more from top-rated insurance companies. Our Private Client team insures our high-net worth and affluent clients.

With our private client insurance group, you can expect:

- An experienced and dedicated team with extensive experience in addressing the diverse insurance needs and expectations of our Private Clients.

- Thorough assessment of potential risks, along with customized insurance solutions to maximize coverage while reducing costs.

- Complete confidentiality throughout the entire process. We insure many celebrity clients and our team is professional and we protect your privacy.

- Our Private Client Insurance Advisors work from professional office settings, not remotely or from an overseas call center.

As a Private Client Insurance Agent, the insurance professionals at Greene Insurance Group works with affluent high-net worth individuals, families or estates to provide personalized insurance solutions. Our Private Client Team has the experience to insure luxury high-value multi-million dollar homes and estates throughout the United States. We insure all of your vehicles to include private passenger autos, SUV’s, luxury automobiles, collector automobiles, classic automobiles, and more. The Trusted Insurance Advisors in the Private Client Team at Greene Insurance Group focus on creating customized insurance plans that meet the unique needs of our affluent auto and home insurance clients, often offering comprehensive coverage that goes beyond most standard insurance policies.

We provide best in class service to our clients

At Greene Insurance, We promise personalized and professional service. Our Team work in a professional office setting, not remotely or from a call center center abroad. We answer our phones and return your calls and emails. The Private Client Insurance Group at Greene Insurance is here to serve you!