Personal Umbrella Insurance in Arizona

Call (480) 657-2800 or (928) 923-6888 for Personal Umbrella Insurance Quotes in Arizona

How important is Personal Umbrella Insurance in Arizona?

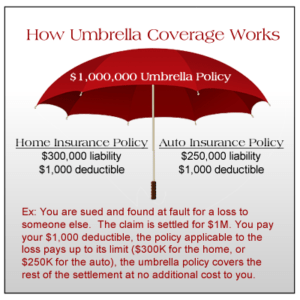

If you are sued, do you have enough coverage on your underlying home insurance and auto insurance to protect you? Do you even know what underlying coverage means? Most people don’t. Once the liability limits are exhausted on your home, auto, or other policy, a Personal Umbrella Insurance can take over and provides a second layer of protection of $1,000,000 or more depending on your assets.

Some ask, if I don’t have assets, what can they sue me for? People are oftentimes sued for the equity in the home or garnish against future wages. Talk with a Licensed Insurance Professional at Greene Insurance Group to determine the right amount of coverage for your needs.

Can I Afford Personal Umbrella Insurance?

If you own a home, rental properties, autos, RV’s or have youthful drivers, you should strongly consider a personal umbrella insurance policy.

If you own a home and auto, most couples with a good driving record can purchase a $1,000,000 personal umbrella policy for less than $20 per month. Families with young household drivers, will pay more, however a personal umbrella is very important to protect those families and their assets.

Personal Umbrella Insurance is very affordable and you will have the peace of mind knowing you’re protected.

Bundle Your Arizona Auto & Home Insurance with a Personal Umbrella Insurance policy & Save Money

When you bundle your auto and home insurance with Greene Insurance Group, we can add $1,000,000 personal umbrella liability coverage for as little as $250 annually.

Examples of why Personal Umbrella Insurance in Arizona is so Important

- Do you have youthful drivers in the household? Statistics show youthful drivers have less driving experience and pose a greater risk to you

- What would happen if your dog was to bite a neighbor’s child?

- Do you own rental property(s)? What if there was an accident on your rental property?

- What if someone in your household was at fault and severely injured or killed another person(s) in an auto accident?

- What would happen if a fire in your condo spread to other units?

- There was a drowning in your swimming pool?

If any of these things happened to you, there’s a good chance your current liability limits wouldn’t be adequate to protect your assets, or your future earnings.

Client Testimonials & Reviews

Greene Insurance Group – Arizona Insurance Agency

Providing Best in Class Service

Since 1962, our family has pledged to protect families and businesses through personal and business insurance products. As an Independent Insurance Agency in Arizona, Greene Insurance Group will review your present insurance coverage and help you compare insurance rates from dozens of top-rated insurance companies. Greene Insurance Group will be your local Arizona Insurance Agent and we’ll be here to make any changes to your policy, answer questions regarding your insurance coverage or potential claims. You can trust our team of professionals for best in class service.

Arizona Independent Insurance Agent

Greene Insurance Group is an locally-owned Independent Insurance Agent in Arizona offering personal insurance and business insurance from top-rated insurance companies. Unlike many other insurance agencies in Arizona, Greene Insurance Group isn’t owned by an insurance company and we offer insurance from dozens of top-rated insurance companies. We’re a locally-owned Arizona Independent Insurance Agent allowing us to customize insurance coverage to save our clients time and money.

Greene Insurance Group offers Personal Insurance such as: Auto Insurance, Home Insurance, Renters Insurance, Condo Insurance, Landlord Insurance, RV Insurance, Motorcycle Insurance, Motorhome Insurance, Boat Insurance and more.

Greene Insurance Group offers Business Insurance such as: Business Liability Insurance, Commercial Property Insurance, Workers Compensation Insurance, Business Auto Insurance, Inland Marine Insurance, Professional Liability Insurance, Commercial Umbrella Insurance and more.

Insurance from Top-Rated Insurance Companies:

Some of the insurance companies we represent in Arizona include: Auto-Owners, Chubb, Cincinnati, Foremost-Farmers, The Hartford, Liberty Mutual, Main Street-American Family, Mercury, National General-Allstate, Nationwide, Progressive, Safeco-Liberty Mutual, Travelers, West Bend and many more specialty insurance companies.

Some may assume purchasing insurance online or direct from an insurance company offers more savings. We have found this isn’t the case. Clients who compare our insurance quotes, coverage, discounts and features versus those of our competitors, find the insurance quotes and service we provide rival our competitors.

Trusted Choice Insurance Agency in Arizona

Some final considerations when purchasing insurance:

- Once you purchase insurance, Who will be your point of contact when a question arises or you need to make a change to your insurance coverage?

- When you reach out to your Insurance Company, what will your experience be? Will you experience long hold times when you call? At Greene Insurance, we answer our calls promptly.

- Insurance rates change from time to time and your needs may change if you move, trade vehicles or have a claim. Does your insurance company or insurance agent offer insurance from other insurance companies? Greene Insurance Group offers personal and business insurance from dozens of top-rated insurance companies. We save our clients the hassles of shopping for insurance saving you time and money.

- Some insurance agents or companies require their customers submit a contact request and wait for an email response. It’s our pledge you will always be our top priority and our licensed insurance agents will answer your call, return messages and respond in a timely fashion.

- You can trust Greene Insurance Group. We save our clients time & money. You can relax knowing when you select Greene Insurance Group, we’re working in your interest to help you understand your insurance and coverage and customize it to fit your unique needs.

When you select Greene Insurance Group, we’ll be your local Arizona Insurance Agent. Our team prides itself with providing best in class service.

Greene Insurance Group serves the following Arizona communities:

Phoenix, Scottsdale, Paradise Valley, Fountain Hills, Cave Creek, Carefree, Anthem, Chandler, Gilbert, Mesa, Queen Creek, San Tan Valley, Tucson, Catalina Foothills, Marana, Oro Valley, Ahwatukee Foothills, Goodyear, Litchfield Park, Buckeye, Surprise, Sun City, Sun City West, Sun City Festival, Waddell, Peoria, Prescott, Prescott Valley, Flagstaff, Sedona and surrounding areas.